1,100+ users already on Karma

The future of

finance is hybrid

Send fiat, swap tokens, withdraw to crypto, all inside one account.

One account.

Two financial worlds.

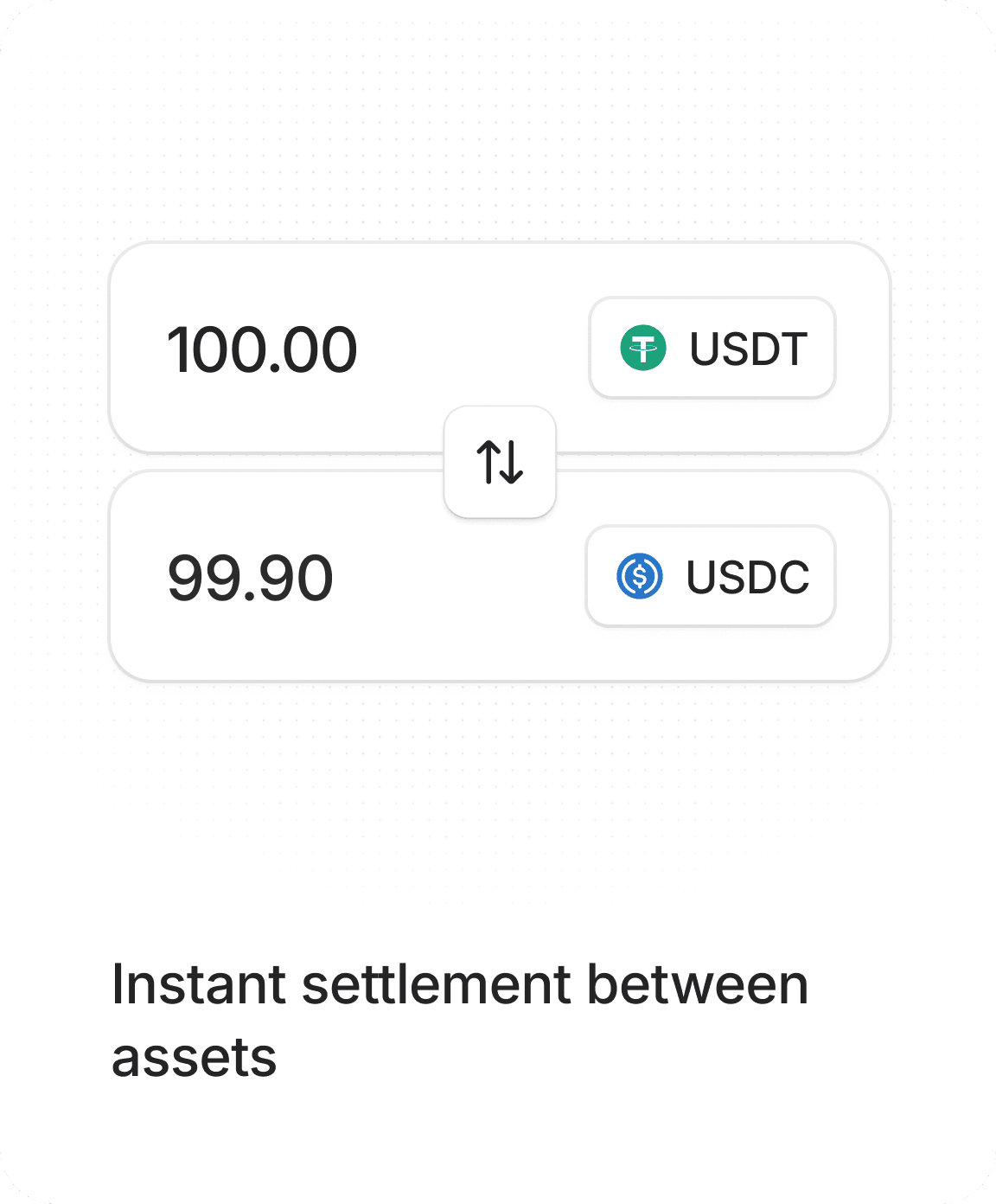

Move money between traditional banking and crypto with instant settlement.

Transfer USDT from your wallet via IBAN

Instant settlement between assets

Buy crypto instantly with no extra steps

Move funds instantly without delays

Everything you expect from a bank,

and everything you need from crypto.

Move money between traditional banking and crypto with instant settlement.

Real IBAN account

Verified IBAN for euro deposits and withdrawals

Instant crypto purchases

Buy digital assets in seconds from your balance.

Solana-integrated wallet

A high-speed wallet on Solana for ultra-fast transactions.

Low fees & fast transfers

Transfer money and crypto quickly without high costs.

Multi-currency support

Manage euros and cryptocurrencies in one place.

Full transparency & security

Clear pricing, secure infrastructure, and full control.

Explore the app interface.

Tap through the core screens and see how Karma works in action.

Introducing the KARMA Token.

Utility. Governance. Value alignment.

Earn rewards for ecosystem activity

Get rewarded automatically for everything you do in the ecosystem

Access premium features

Unlock advanced tools and exclusive platform capabilities

Reduced trading fees

Save more on every trade with lower, loyalty-based fees

Community voting

Transfer money and crypto quickly without high costs

Security you can fully trust.

Built with bank-grade security and transparent architecture.

Compliance with EU financial standards

Encrypted key custody

SOC2-level infrastructure

Transparent smart-contract logic